"Learn With Us, Grow With Us"

ACCA Online Course

"Learn With Us, Grow With Us"

Why ACCA?

Association of Chartered Certified Accountants

ACCA is the Association of Chartered Certified Accountants, world’s most forward-thinking professional accountancy body based in the UK with 115+ years of experience. ACCA is a globally accepted qualification for successful careers in finance, accounting, banking, consulting and management. ACCA course provides excellent career opportunities in India and abroad, to commerce students and professionals, creating strategic-thinking business managers globally.

- ACCA is the global body for professional accountants with over 219,000 members and 527,000 students in 179 countries

- One of the oldest professional body with over 100 years and has built a reputation that is recognized around the world.

- ACCA qualification is based on international accounting standards making it globally relevant.

- ACCA works through a network of 110 offices and centres and more than 7571 Approved Employers worldwide.

Why ACCA?

Association of Chartered Certified Accountants

ACCA is the Association of Chartered Certified Accountants, world’s most forward-thinking professional accountancy body based in the UK with 115+ years of experience. ACCA is a globally accepted qualification for successful careers in finance, accounting, banking, consulting and management. ACCA course provides excellent career opportunities in India and abroad, to commerce students and professionals, creating strategic-thinking business managers globally.

- ACCA is the global body for professional accountants with over 219,000 members and 527,000 students in 179 countries

- One of the oldest professional body with over 100 years and has built a reputation that is recognized around the world.

- ACCA qualification is based on international accounting standards making it globally relevant.

- ACCA works through a network of 110 offices and centres and more than 7571 Approved Employers worldwide.

About ACCA

Course Structure

ACCA is the Association of Chartered Certified Accountants, world’s most forward-thinking professional accountancy body based in the UK with 115+ years of experience. ACCA is a globally accepted qualification for successful careers in finance, accounting, banking, consulting and management. ACCA course provides excellent career opportunities in India and abroad, to commerce students and professionals, creating strategic-thinking business managers globally.

- ACCA is the global body for professional accountants with over 219,000 members and 527,000 students in 179 countries

- One of the oldest professional body with over 100 years and has built a reputation that is recognized around the world.

- ACCA qualification is based on international accounting standards making it globally relevant.

- ACCA works through a network of 110 offices and centres and more than 7571 Approved Employers worldwide.

About ACCA

Course Structure

ACCA is the Association of Chartered Certified Accountants, world’s most forward-thinking professional accountancy body based in the UK with 115+ years of experience. ACCA is a globally accepted qualification for successful careers in finance, accounting, banking, consulting and management. ACCA course provides excellent career opportunities in India and abroad, to commerce students and professionals, creating strategic-thinking business managers globally.

- ACCA is the global body for professional accountants with over 219,000 members and 527,000 students in 179 countries

- One of the oldest professional body with over 100 years and has built a reputation that is recognized around the world.

- ACCA qualification is based on international accounting standards making it globally relevant.

- ACCA works through a network of 110 offices and centres and more than 7571 Approved Employers worldwide.

Benefits of ACCA

ACCA is the Association of Chartered Certified Accountants, world’s most forward-thinking professional accountancy body based in the UK with 115+ years of experience. ACCA is a globally accepted qualification for successful careers in finance, accounting, banking, consulting and management. ACCA course provides excellent career opportunities in India and abroad, to commerce students and professionals, creating strategic-thinking business managers globally.

- Employers everywhere have a great admiration among ACCAs. ACCA membership is a key to wealth of opportunities around the globe.

- ACCA membership stands for recognizable symbol that places you apart when employers are selecting for interviews.

- ACCA’s global presence signifies that whichever country you take into consideration, you will find community members who are clicks away and assisting with the information on the job market, salaries, and recruiters.

- Commerce, industry, and financial services:- These include CFOs, financial controllers, & heads of finance, leading finance teams across sectors. Many are also moving into business management roles, as CEOs or Director of resource etc.

- Professional Services:- ACCA members are in demand as auditors and accountants, advising MNCs on tax strategy, corporate recovery, risk management, transaction support etc. Many acts as consultants. Some manage their own practice, providing accounting and booking services.

- Not for profit organizations:- The prowess of ACCA members make them in highly demanding for public bodies and charities, desirous to manage sparse resources effectively and incorporating best practice in financial reporting, procurements, and systems.

ACCA has established mutual acknowledgment agreements with several key prestigious global accountancy bodies:

- The Certified General Accountants Association of Canada

- The Hong Kong Institute of Certified Public Accountants

- The Malaysian Institute of Certified Public Accountants

- UAE – AAA (Accountants and Auditors Association)

- CA Australia and New Zealand

These agreements render unsophisticated and inexpensive routes for ACCA members to become a member of their bodies and appreciate the services local organizations can offer.

Benefits of ACCA

ACCA is the Association of Chartered Certified Accountants, world’s most forward-thinking professional accountancy body based in the UK with 115+ years of experience. ACCA is a globally accepted qualification for successful careers in finance, accounting, banking, consulting and management. ACCA course provides excellent career opportunities in India and abroad, to commerce students and professionals, creating strategic-thinking business managers globally.

- Employers everywhere have a great admiration among ACCAs. ACCA membership is a key to wealth of opportunities around the globe.

- ACCA membership stands for recognizable symbol that places you apart when employers are selecting for interviews.

- ACCA’s global presence signifies that whichever country you take into consideration, you will find community members who are clicks away and assisting with the information on the job market, salaries, and recruiters.

- Commerce, industry, and financial services:- These include CFOs, financial controllers, & heads of finance, leading finance teams across sectors. Many are also moving into business management roles, as CEOs or Director of resource etc.

- Professional Services:- ACCA members are in demand as auditors and accountants, advising MNCs on tax strategy, corporate recovery, risk management, transaction support etc. Many acts as consultants. Some manage their own practice, providing accounting and booking services.

- Not for profit organizations:- The prowess of ACCA members make them in highly demanding for public bodies and charities, desirous to manage sparse resources effectively and incorporating best practice in financial reporting, procurements, and systems.

ACCA has established mutual acknowledgment agreements with several key prestigious global accountancy bodies:

- The Certified General Accountants Association of Canada

- The Hong Kong Institute of Certified Public Accountants

- The Malaysian Institute of Certified Public Accountants

- UAE – AAA (Accountants and Auditors Association)

- CA Australia and New Zealand

These agreements render unsophisticated and inexpensive routes for ACCA members to become a member of their bodies and appreciate the services local organizations can offer.

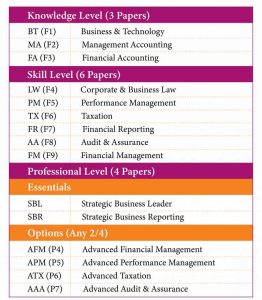

ACCA Overall Structure

The ACCA syllabus consists of 13 papers that are divided into four different levels:

- Business and Technology (BT)

- Management Accounting (MA)

- Financial Accounting (FA)

- Corporate and Business Law (LW)

- Performance Management (PM)

- Taxation (TX)

- Financial Reporting (FR)

- Audit and Assurance (AA)

- Financial Management (FM)

- Strategic Business Leader (SBL)

- Strategic Business Reporting (SBR)

This module requires you to select 2 ACCA papers to study from a choice of 4, allowing you to tailor your programme to suit your requirements, interests and career aspirations.

- Advanced Financial Management (AFM)

- Advanced Performance Management (APM)

- Advanced Taxation (ATX)

- Advanced Audit and Assurance (AAA)

ACCA Overall Structure

The ACCA syllabus consists of 13 papers that are divided into four different levels:

- Business and Technology (BT)

- Management Accounting (MA)

- Financial Accounting (FA)

- Corporate and Business Law (LW)

- Performance Management (PM)

- Taxation (TX)

- Financial Reporting (FR)

- Audit and Assurance (AA)

- Financial Management (FM)

- Strategic Business Leader (SBL)

- Strategic Business Reporting (SBR)

This module requires you to select 2 ACCA papers to study from a choice of 4, allowing you to tailor your programme to suit your requirements, interests and career aspirations.

- Advanced Financial Management (AFM)

- Advanced Performance Management (APM)

- Advanced Taxation (ATX)

- Advanced Audit and Assurance (AAA)

ACCA vs CA

ACCA and CA are two of the most prestigious qualifications. However, since CA is a local qualification, it is well-recognized in India and offers relatively more when it comes to the local career opportunities. However, when it comes to global recognition and career opportunities, ACCA has the upper hand in comparison to CA.

ACCA Journey

Eligibility Requirement

10th Passed Students can pursue ACCA qualification via CAT/FIA route. Students have to pass 7 papers of FIA or 9 papers of CAT to transfer themselves into ACCA. They will be also exempted from AB, MA, FA.

Requirement:

- Minimum 60% marks in Maths

- Minimum 60% marks in English

- Minimum 50% marks in other subjects

12th or +2 passed students can pursue ACCA if they fulfill

Requirement:

- Minimum 65% marks in Accounts or Maths

- Minimum 65% marks in English

- Minimum 50% marks in other subjects

STUDENTS WHO DON’T MEET THE ELIGIBILITY CRITERIA

If the students are having less marks for minimum entry requirement for ACCA, then the students can enter into ACCA by passing 3 papers of Diploma in Accounting and Business ( FFA, FFB, and FFM ) of Foundation of Accounting of ACCA. After successful completion a student will be eligible for exemptions of the following 3 papers:

- Business and Technology (BT)

- Management Accounting (MA)

- Financial Accounting (FA)

The estimated duration of course will be 3 years.

B.COM / BSc. Accounting qualified can enter into ACCA with the exemption of 4 papers of ACCA out of total 13 papers.

Please check your University at ACCA website for exemption claim purpose – Exemption Enquiry Database

The estimated duration of course will be 1.5 years

For Other Graduates

- BBA will get exemption of one paper( AB )

- LLB will get exemption of one paper ( LW )

Other Graduates can also enter into ACCA. For more information please contact via email: info@tishadz.com or call at +91-9811160007

MBA can enter into ACCA with the exemption of 3 papers out of 13 papers of ACCA.

Following exempted papers are as follows:-

- Business and Technology (BT)

- Management Accounting (MA)

- Financial Accounting (FA)

In that case a student will have to appear for 10 papers of ACCA. These are as follows:

- Corporate and Business Law (LW)

- Performance Management (PM)

- Taxation (TX)

- Financial Reporting (FR)

- Audit and Assurance (AA)

- Financial Management (FM)

- Strategic Business Reporting (SBR)

- Strategic Business Leader (SBL)

The other 2 …….. A student has to choose two papers from the following four papers.

- Advanced Financial Management(AFM)

- Advanced Performance Management (APM)

- Advanced Taxation (ATX)

- Advanced Audit and Assurance(AAA)

They can study both as a full time and as a working student.

- Full time student can finish in 1.5 years

- Working student may finish in 2.5 years

CA-IPCC can enter into ACCA with the exemption of 6 papers out of total 13 papers. So, they have to sit for 7 papers only.

The 6 exempted papers are as follows:

- Business and Technology (BT)

- Management Accounting (MA)

- Financial Accounting (FA)

- Corporate and Business Law (LW)

**Condition:-This paper can only be exempted if student has qualified IPC with B.COM

- Taxation (TX)

- Financial Reporting (FR)

The 7 papers they have to sit for as follows

- Corporate and Business Law (LW)

- Financial Reporting (FR)

- Financial Management (FM)

- Strategic Business Leader (SBL)

- Strategic Business Reporting (SBR)

The other 2 >> A student has to choose two papers from the following four papers.

- Advanced Financial Management(AFM)

- Advanced Performance Management (APM)

- Advanced Taxation (ATX)

- Advanced Audit and Assurance(AAA)

CA/IPCC can finish ACCA in one year as a full time student.

CA and CMA can enter into ACCA with the exemption of 9 papers out of total 13 papers, which means they have to sit for only 4 papers.

9 Exempted papers are as follows:

- Business and Technology (BT)

- Management Accounting (MA)

- Financial Accounting (FA)

- Corporate and Business Law (LW)

- Performance Management (PM)

- Taxation (TX)

- Financial Reporting (FR)

- Audit and Assurance (AA)

- Financial Management (FM)

The 4 papers they have to sit for are as follows:

- Strategic Business Leader (SBL)

- Strategic Business Reporting (SBR)

The other 2 >> A student has to choose two papers from the following four papers.

- Advanced Financial Management(AFM)

- Advanced Performance Management (APM)

- Advanced Taxation (ATX)

- Advanced Audit and Assurance(AAA)

They can qualify ACCA within 6 to 9 months.

Our Learning Methodology