Choosing the right Accounting policy: What does this mean in IFRS?

What are accounting Policies?

Accounting policies refer to specific principles or rules that are applied to a transaction, event or operation when organizing and presenting financial statements (by an entity). Accounting policies incorporate recognition, measurement to presentations and disclosures. However, to choose the right accounting policy, many firms for their transactions, events or conditions choose to apply specific IFRS Standards in their decision making. This is mainly done to help users understand the accounting policies adopted and how they have been implemented. Accounting policies are defined by IFRS, specifically FRS 18 as “principles, bases, conventions, rules and lastly, practices applied by any entity that specify how the effects of transactions and other events are to be reflected in the financial statements”

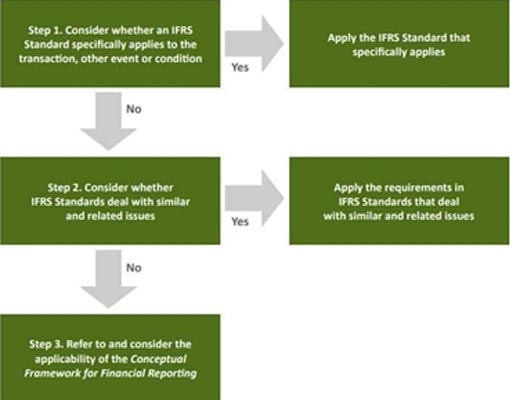

IFRS and Accounting Policies

According to IFRS, keeping in mind all constituent factors, multiple entities should implement policies that enable their financial statements to give a true and fair sight. Moreover, under IFRS, the accounting policies should be consistent with the requirements of accounting standards and the company’s lawmaking body. If, however, compliance with the accounting standard is fickle, then the entities are liable to shift from that standard, however such cases are quite rare.

Usually in IFRS, choosing the right accounting policy assists in adopting the right type of transaction and selection of whether or not to differentiate elements such as assets, liabilities, gains or losses as anoutcome of transactions (recognition criteria), or how to attribute a monetary volume to specific elements recognized centered on measurements and lastly, where to present them in the financial statements.

Going Concern and Accruals

IFRS states that there are two concepts that play a wide role in selecting the right accounting policy; the going concern concept and the accruals concept. Firstly, financial statements are usually prepared under the supposition that the specific entity is a going concern. This is mainly because measures based on break-up values incline not to be related to users seeking to weigh the entity’s ability to generate cash and be financially adaptable. Additionally, when preparing financial statements executives should assess whether there are substantial doubts about an entity’s ability to carry on as a going concern.

Other than in the cash flow statement, the accruals concept of accounting requires the non-cash effects of transactions to be replicated in the financial statements for the period in which they transpire. IFRS states that the accruals concept lies at the core of the definitions of assets and liabilities that are set out in FRS 5 ‘Reporting the Substance of Transactions’. It is to be noted that the concept of accruals is closely associated with the concept of realization. Companies legislation only allows profits that are gathered by the balance sheet to be included within the profit and loss account.

Reviewing Accounting Policies

Moreover, IFRS requires entities to review their accounting policies on a regular basis and change them where applicable. However, any decision to change a certain accounting policy must be taken keeping in mind the significance of comparability since frequent changes to accounting policies are not wanted because they make comparison more difficult. Conversely, consistency is not an end in itself and it does not impede the introduction of improved accounting practices that result in enhanced information for users.

With the issue of a new financial reporting standard, an entity should work to review its accounting policies before the standard takes effect. Whilst IFRS does not require the early adoption of a newly issued IFRS, it appears to allow entities to do this.

IFRS, Estimation and AP

Lastly, there is a close relation between estimation and accounting policies. Under IFRS, these methods adopted by an entity to arrive at the projected monetary amounts for components of the financial statements, however, the distinction between accounting policies and estimation techniques is important. FRS 18 says that a change of accounting policy has occurred where there has been a change to any one of its components, consequently, IFRS requires entities to select techniques that allow financial statements to give a true and fair view. Similarly, estimations are by definition somewhat subjective. FRS 18 requires estimation to be as accurate as possible yetis acquainted withthe fact that in deciding on the complexity of the estimation technique used, cost/benefit considerations clearly come into power.

Conclusion

Hence subsequently, it is useful in the context of IFRS to note that the financial statements require entities to identify the accounting policies selected, the respective key estimation techniques used, specific details of any changes to accounting policies, any relevant information to the assessment of an organization as a going concern, if the going concern basis is under question and details of accounting standard or company’s lawmaking body in the interest of showing a true and fair view.

Responses